Navigating the California Landscape: Understanding USDA Loan Eligibility

Related Articles: Navigating the California Landscape: Understanding USDA Loan Eligibility

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the California Landscape: Understanding USDA Loan Eligibility. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the California Landscape: Understanding USDA Loan Eligibility

The United States Department of Agriculture (USDA) offers a range of loan programs designed to support rural development and promote homeownership opportunities in eligible areas. While often associated with expansive farmlands, USDA loan programs extend beyond traditional agricultural settings. In California, these programs can be particularly valuable for individuals seeking to purchase homes in specific rural communities.

This comprehensive guide delves into the intricacies of USDA loan eligibility in California, providing valuable insights into program requirements, benefits, and the crucial role of the USDA loan map.

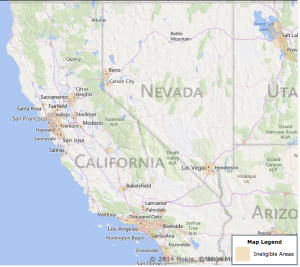

Decoding the USDA Loan Map: A Visual Guide to Eligibility

The USDA loan map serves as a visual representation of eligible areas for USDA loan programs. This map is an essential tool for prospective borrowers, as it clearly delineates regions where these programs are available.

Understanding the Map’s Color Code:

The USDA loan map employs a simple color code to indicate eligibility:

- Green: Represents areas fully eligible for USDA loan programs.

- Yellow: Denotes areas with limited eligibility, often requiring specific program guidelines or restrictions.

- Red: Indicates areas ineligible for USDA loan programs.

Navigating the Map’s Layers:

The USDA loan map is interactive, allowing users to zoom in and out, explore specific areas, and access additional information. This interactive feature empowers potential borrowers to understand the nuances of eligibility within their desired location.

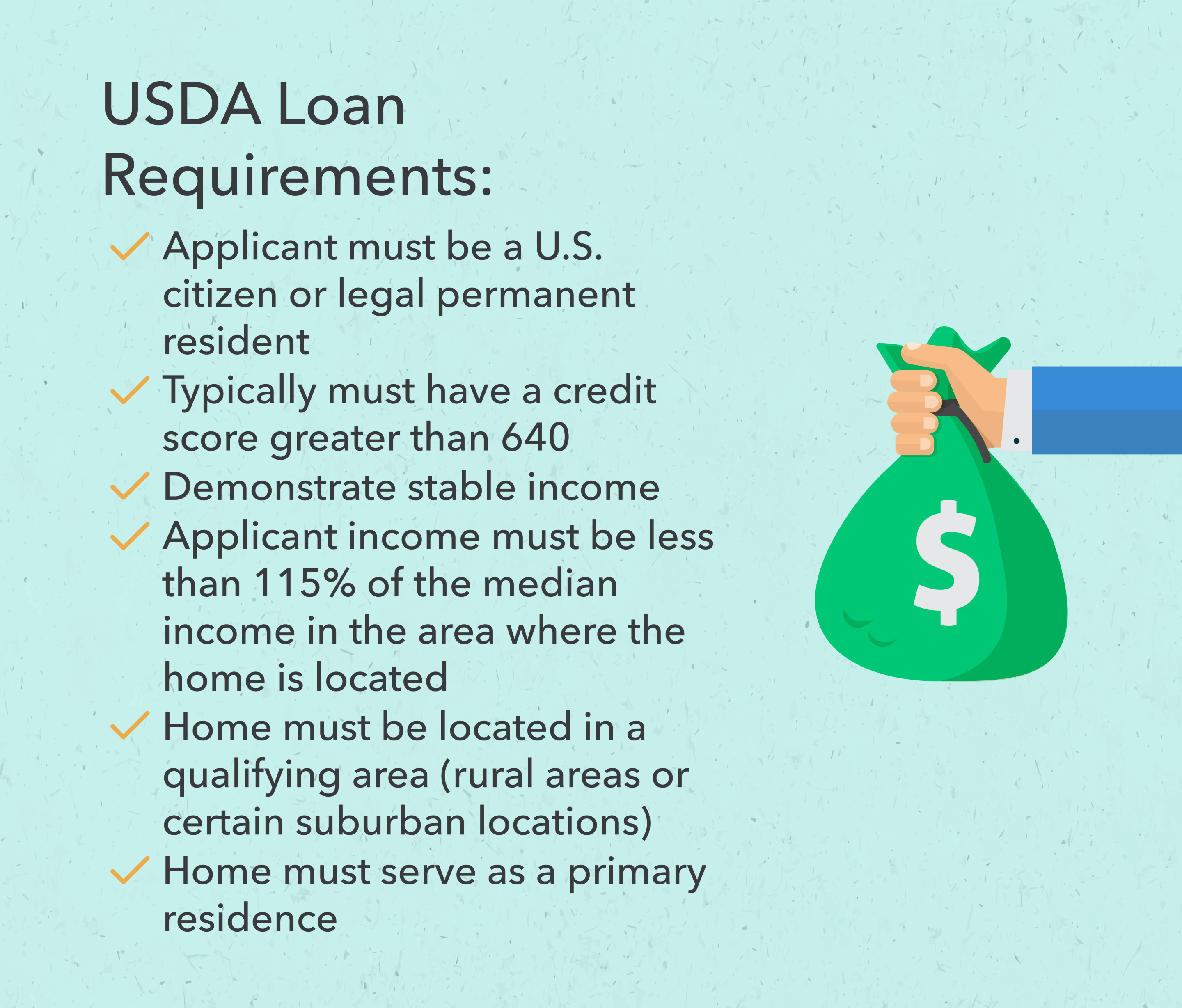

Beyond the Map: Eligibility Criteria

While the USDA loan map offers a preliminary assessment of eligibility, several other factors determine loan approval. These criteria include:

- Income: The borrower’s income must fall within the USDA’s income limits for the specific county or region.

- Credit Score: A minimum credit score is typically required, though specific requirements may vary depending on the program.

- Property Type: The property must be a single-family home located in an eligible area and meet specific USDA guidelines.

- Debt-to-Income Ratio: The borrower’s total debt obligations must be within acceptable limits.

Advantages of USDA Loans in California

USDA loans offer several distinct advantages to eligible borrowers in California:

- Lower Down Payment: Compared to conventional mortgages, USDA loans often require a lower down payment, making homeownership more accessible.

- No Private Mortgage Insurance (PMI): USDA loans do not require PMI, which can significantly reduce monthly mortgage payments.

- Competitive Interest Rates: USDA loan interest rates are typically competitive with other mortgage options.

- Rural Development Focus: USDA loans prioritize investment in rural communities, fostering economic growth and revitalization.

The Role of the USDA Loan Map in California

The USDA loan map plays a pivotal role in guiding potential borrowers in California:

- Identifying Eligible Areas: The map clearly identifies areas eligible for USDA loan programs, allowing borrowers to focus their home search on suitable locations.

- Understanding Program Limitations: The map helps borrowers understand the extent of program coverage and any potential restrictions within specific areas.

- Facilitating Informed Decision-Making: By providing a visual representation of eligibility, the map empowers borrowers to make informed decisions about their home purchase.

Navigating the Process: Tips for Success

- Research Your Eligibility: Utilize the USDA loan map and explore the USDA website for detailed eligibility requirements.

- Seek Professional Guidance: Consult with a mortgage lender experienced in USDA loan programs for personalized advice and assistance.

- Prepare Thoroughly: Gather all necessary documentation, including income verification, credit reports, and property information.

- Understand Loan Terms: Carefully review the loan terms and conditions, including interest rates, repayment schedules, and any potential fees.

Frequently Asked Questions

Q: What is the maximum income limit for USDA loans in California?

A: The maximum income limit varies by county and household size. The USDA website provides specific income limits for each county in California.

Q: What credit score is required for a USDA loan?

A: A minimum credit score of 640 is typically required for USDA loans, though lenders may have slightly different requirements.

Q: Can I use a USDA loan to purchase a home in a rural area near a major city?

A: While USDA loans are primarily for rural areas, some areas near major cities may qualify. Refer to the USDA loan map for specific eligibility.

Q: What are the closing costs for a USDA loan?

A: Closing costs for USDA loans vary depending on the lender and the specific loan terms. These costs typically include appraisal fees, title insurance, and loan origination fees.

Q: What are the restrictions on property size and type for USDA loans?

A: USDA loans have restrictions on property size and type. The home must be a single-family residence and meet specific guidelines regarding acreage and square footage.

Conclusion

The USDA loan map is a valuable tool for individuals seeking to utilize USDA loan programs in California. By understanding the map’s features, eligibility criteria, and program benefits, potential borrowers can navigate the process effectively and unlock opportunities for homeownership in eligible areas. The USDA’s commitment to rural development through these programs continues to empower Californians and foster vibrant communities across the state.

Closure

Thus, we hope this article has provided valuable insights into Navigating the California Landscape: Understanding USDA Loan Eligibility. We thank you for taking the time to read this article. See you in our next article!